A manufacturer is able to standardize processes while at the same time attempting to cater to individual customer needs. For example it is the costing accounting system most appropriate for an event management company a niche furniture producer a producer of very high cost air surveillance system etc.

Pdf Formation Of Hybrid Costing System Accounting Model At The Enterprise

Hybrid Costing Systems.

. Using FIFO costing equivalent units of production EUP can be determined by subtracting EUPs in Beginning work in process from weighted average EUP. A business can accumulate information based on either one or adopt a hybrid approach that mixes and matches systems to best meet its needs. A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs.

Standard costing is compatible with both FIFO and weighted average methods of costing. The primary costing systems are noted below. Large quantities of identical products are being produced.

See Page 1. A hybrid costing system would be most appropriate when. Large quantities of identical products are being produced.

Newton Quiches uses a weighted average process costing system. Large quantities of identical products are being produced. Process costing and job order costing are both acceptable methods for tracking costs and production levels.

The volume of production is low and costs are high. Pots and pans l. The volume of production is low and costs are high.

The volume of production is low and costs are high. A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs. A billing system estimates the fees to be charged to the client for the service based on chargeout rates per billable hour.

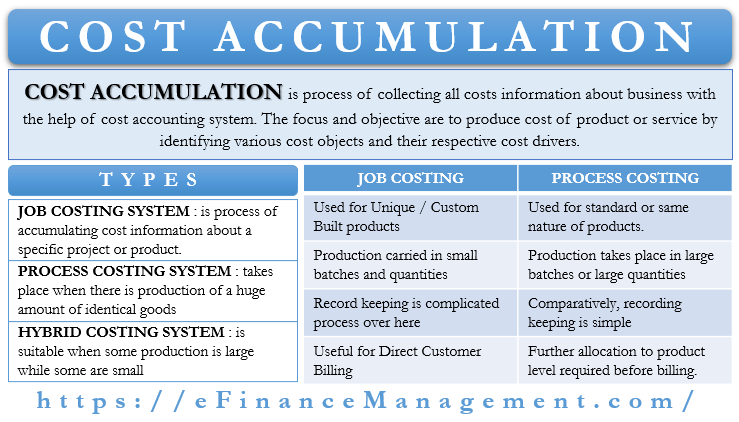

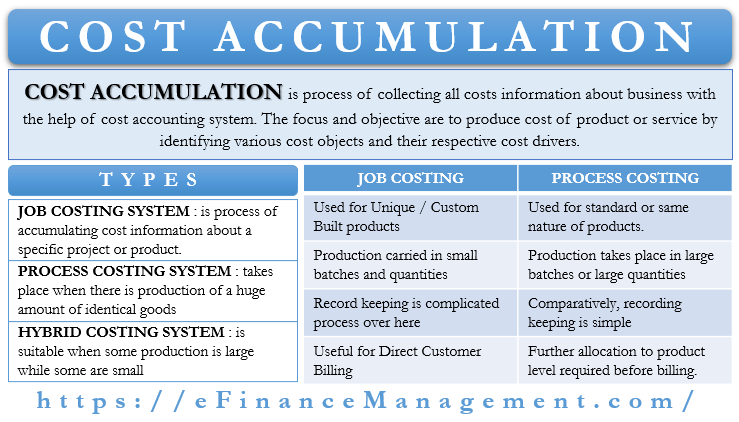

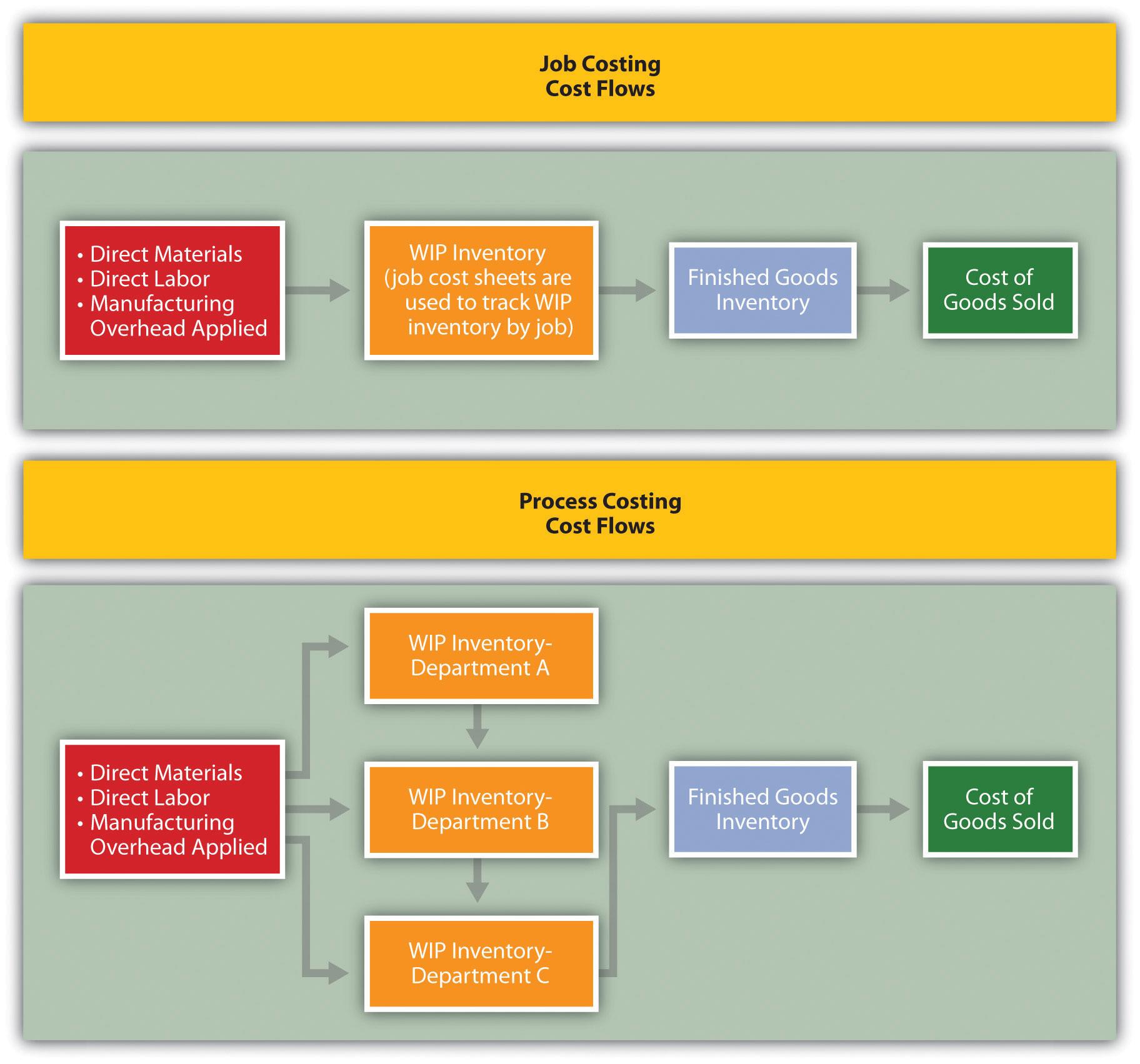

A costing system accumulates the amounts that the service costs the firm to provide. Some important variants from these two basic systems are as under. Job Costing System Materials labor and overhead costs are compiled for an individual unit or job.

In this case cost accountants and managers would most likely use a hybrid costing system to track the manufacturing expenses of producing a motorcycle. What is prime cost formula. Name these companies provide their Web addresses indicate what products they make and discuss why you believe they use process costing.

A hybrid costing system would be most appropriate when. A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs. A hybrid costing system would be most appropriate when.

CPA review course j. The volume of production is low and costs are high. There is no standardization of units of.

Personal computer with special. A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs. Question 5When Company A is selling receivables for Company B the reason of selling receivables might be A.

A hybrid costing system would be most appropriate when. A hybrid costing system would be most appropriate when. Large quantities of identical products are being produced.

Some companies use a single method while some companies use both which creates a hybrid costing system. A hybrid costing system would be appropriate for a company that manufactures cake flour. Large quantities of identical products are being produced.

Indicate which costing system job-order process or hybrid would be most appropriate Indicate which costing system job-order process or hybrid would be most appropriate for the. The volume of production is low and costs are high. But in practice the cost systems of many firms do not exactly fit in the category of either job crossing or process costing.

All material is added at the start of the production process. Large quantities of identical products are being produced. Date Transactions Amounts 20.

A manufacturer is able to standardize processes while at the same time attempting to cater to individual customer needs. Asked Sep 13 2019 in Business by Hristo. A hybrid costing system would be most appropriate when.

Large quantities of identical products are being produced. Materials labor and overhead costs are compiled for an individual unit or job. Work in process inventory is the cost per unit and the equivalent units remaining to be completed.

Asked Jan 10 2019 in Business by Platini A A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs. Multiple Choice A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs. There is no standardization of units of production.

The primary costing systems are. Large quantities of identical products are being produced. There are situations when a firm uses a combination of features of both job-order costing and process costing in what is called hybrid cost accounting system.

A hybrid costing system would be appropriate for a company that manufactures several varieties of jam. A business can accumulate information based on either one or adopt a hybrid approach that mixes and matches systems to best meet its needs. The volume of production is low and costs are high.

Direct labor and overhead are added at the same rate throughout the process. The volume of production is low and costs are high. There are two main types of costing systems.

We have seen that the cost systems based on the historical cost are broadly classified into two Job costing and Process costing. Multiple Choice A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs. A hybrid costing system would be most appropriate when.

A hybrid costing system would be most appropriate when. A hybrid costing system would be most appropriate when. A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs.

Process costing systems would be used for the mass produced parts like the bike frames. There is no standardization of units of production. Where as job costing systems would be used for the customized parts and custom assembly processes on each motorcycle.

A hybrid costing system would be most appropriate when. In a process costing system direct material costs incurred are recorded. There are two main types of costing systems.

6-A hybrid costing system would be appropriate for a company that manufactures several varieties of jam. 06-06 Identify whether job process or hybrid costing is most appropriate for the various types of service entities.

Bpc32603 Topic 4 Process Costing Ppt Download

Cost Accumulation Meaning Type Accumulation Vs Allocation More Efm

0 Comments